Is the Platinum American Express Card Worth It?

If you're considering the Platinum American Express® Card in the UK, you're likely weighing it’s premium price tag against it’s equally premium benefits. This is not a traditional credit card as the APR is 694.9% so we treat it as a charge card. The AMEX Platinum has built a reputation for offering serious lifestyle, travel, and insurance benefits but with a hefty annual fee, it's not for everyone.

We will break down the main perks, the downsides, and ultimately help you decide whether the Amex Platinum is a good fit for you if you live in the UK.

Key Benefits of the Platinum Amex Card for UK card holders

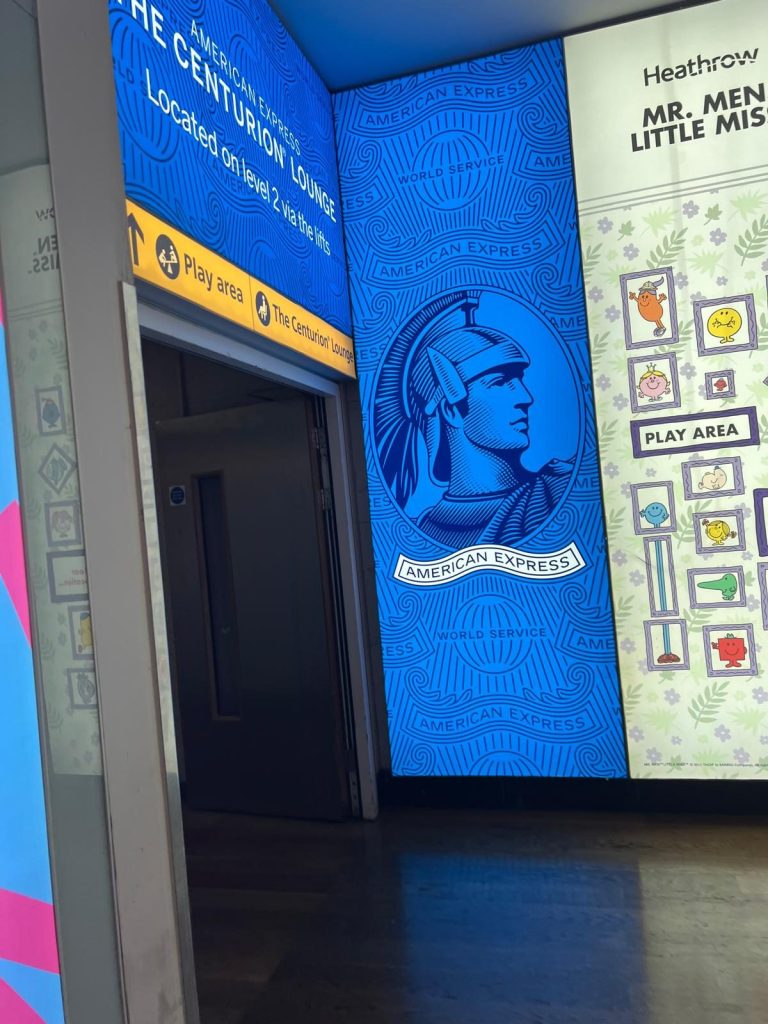

1. Airport Lounge Access (Priority Pass & More)

- Unlimited access to over 1,400 airport lounges worldwide, including Priority Pass lounges, Amex’s Centurion Lounges, Plaza Premium, and Escape Lounges.

- You can also bring one guest for free.

- Perfect for frequent travellers who value comfort and quiet pre-flight

We have used this feature countless times and it makes the pre-flight experience so much smoother. The lounges offer a calm environment and allow us to relax and grab a bite to eat without the hustle and bustle of crowds of people in the terminal.

2. Travel Insurance

- Comprehensive worldwide travel insurance that covers:

- Trip cancellation/interruption (up to £7,500)

- Lost or delayed baggage

- Medical expenses (up to £10 million)

- Car hire excess cover

- Covers both the cardholder and supplementary cardholder (and eligible family members).

We use the travel insurance every time we go away. It’s great to know we have it there if we need it, the same goes for the car hire excess cover.

3. £400 Annual Dining Credit

- £200 UK dining credit and £200 international dining credit each year.

- Can be used at participating high-end restaurants.

- The credits are split into two periods: £100 is available from January to June, and another £100 from July to December for both UK and international dining.

We have managed to use this in various restaurants across the U.K, Europe and The US which we would never have considered without the dining credit. I have listed some of our favourites that we have visited.

- Girafe Restaurant - 1 Pl. du Trocadéro et du 11 Novembre, 75016 Paris, France

- Tribeca Grill - 375 Greenwich St, New York, NY 10013, United States

- Oblix - The Shard, 31 St Thomas St, London SE1 9RY

- The Ivy – various locations across London, Norwich and Cambridge.

4. Hotel Status Upgrades

- Instant elite status with several hotel chains:

- Hilton Honors Gold

- Marriott Bonvoy Gold Elite

- Radisson Rewards Premium

- MeliaRewards Gold

- These can include room upgrades, late check-outs, and bonus points.

This is one of our favourite features, we have had some amazing upgrades with the most epic views. Hilton hotels are great for guaranteed free breakfast thanks to Hilton gold status.

5. Fine Hotels & Resorts Program

- Exclusive benefits when booking luxury hotels via Amex Travel, including:

- Room upgrades

- Free breakfast for two

- Guaranteed 4pm late checkout

- On-property credit (e.g., $100 for spa/restaurant)

Late check out is a blessing when your flight isn’t until later in the day, we have used this so many times.

6. Rewards & Welcome Bonus

- Earn Membership Rewards points (1 point per £1 spent).

- Redeem for flights, hotel stays, gift cards, or even transfer to partners like Avios, Virgin Points, and Emirates Skywards.

- Regular welcome bonus for new users, often around 60,000 points when you meet the spend criteria (usually £6,000 in the first 6 months).

There are various offers on the Amex app and website that pop up such as, cashback on hotel chains and some airlines. An example of a current offer as of 1st June 2025 (expiry 8th August 2025) is with United Airlines - Spend £700 or more and get £300 back on UK departed flights. We have managed to get some really nice hotels booked through offers such as buy on night get on free. This means we can stay in nicer hotels with a higher price tag as it makes them more affordable.

7. No Pre set Spending Limit

- Unlike a standard credit card, there’s no hard credit limit — though purchases are approved based on your spending history and credit profile.

8. Supplementary Cards

- Add one free supplementary Platinum cardholder (who gets their own lounge access and perks).

The supplementary card holder can also reap the rewards of the cards benefits such as their own priority pass card.

Downsides of the Platinum Amex UK Card

Despite its premium appeal, it’s not all upside. Here are the drawbacks you need to consider:

1. £650 Annual Fee

- This is the highest annual fee on any personal card in the UK.

- Unless you’re maximising the lounge access, travel perks, and dining credit, the card may not be worth it.

On our trip in April 2025 (Hong Kong, Shanghai and Tokyo) we covered this easily with all our trips to airport lounges, so it paid for itself. Obviously, this wouldn’t apply to everyone so is a massive factor to consider.

2. Not Everywhere Accepts Them

- American Express is still not accepted as widely in the UK as Visa or Mastercard, especially among small retailers.

- You’ll need a backup card for everyday use.

If you think you could easily rack up some Amex points by using your card regularly on small shops you might need to reconsider. Places like Homebargains, BnM, Superdrug and Greggs do not accept Amex as a form of payment.

3. Exceptionally high APR at 694.9%

- If you don’t pay your balance in full each month the charges will be astronomical unlike a typical credit card.

4. Reward Rate

- The 1 point per £1 spent isn’t as strong as some other reward cards.

- No bonus points on specific categories (like groceries, fuel, etc.)

5. Eligibility Criteria

- The application requires a strong credit profile.

- You usually need to earn over £35,000/year, though approval criteria can vary.

Who Should Get the Platinum Amex in the UK?

- Frequent travellers (especially those who fly business or premium economy)

- Luxury hotel guests looking to stack elite perks and upgrades

- High spenders who want to maximise points and prestige

- Business owners who travel often and want supplementary cards

Who Should Avoid It?

- Casual spenders or those who rarely travel

- Anyone uncomfortable with a £650 annual fee

- Shoppers who need a widely accepted card for daily purchases

- People who need credit flexibility (this is not a revolving credit card)

Final Verdict

We think the Platinum American Express UK Card is packed with high end travel and lifestyle benefits that can more than pay for the £650 fee, but only if you use them.

If you travel frequently, stay at premium hotels, and can take advantage of the insurance, lounge access, and dining perks, this card can be exceptional value. If you’re not in that bracket, however, there are far better value for money options available.

Interested on how we save money travelling?

If you would like our top tips and tricks on how we save money when it comes to travel, dm us on Instagram with the word SAVE.

Disclaimer:

The content in this blog post is for informational and entertainment purposes only and does not constitute financial, legal, or investment advice. We are not financial advisors, and we recommend you seek professional guidance tailored to your individual circumstances before making any financial decisions. We accept no responsibility or liability for any actions taken based on the information provided. Use of this information is at your own risk.